Transparency, performance, and well-being for the long term mutual fund investor.

Our company road-map includes licensing WIA technology via performance based agreements, prior to serving a larger customer base. Our website will provide a growing list of qualified professionals licensed to offer our flagship product to the individual investor.

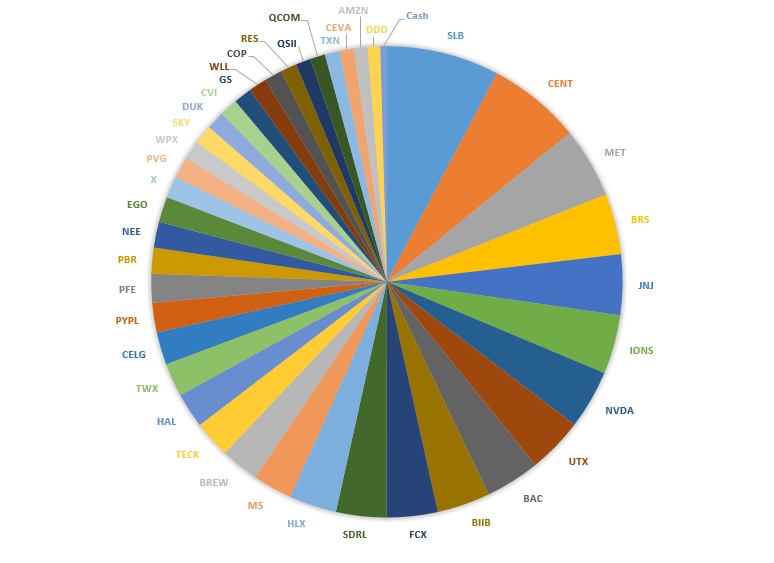

Stock Allocation - Wynmrh Fund

The following pie chart represents the end of year stock and cash holdings on December 31, 2016.

One outperforming Mutual Fund

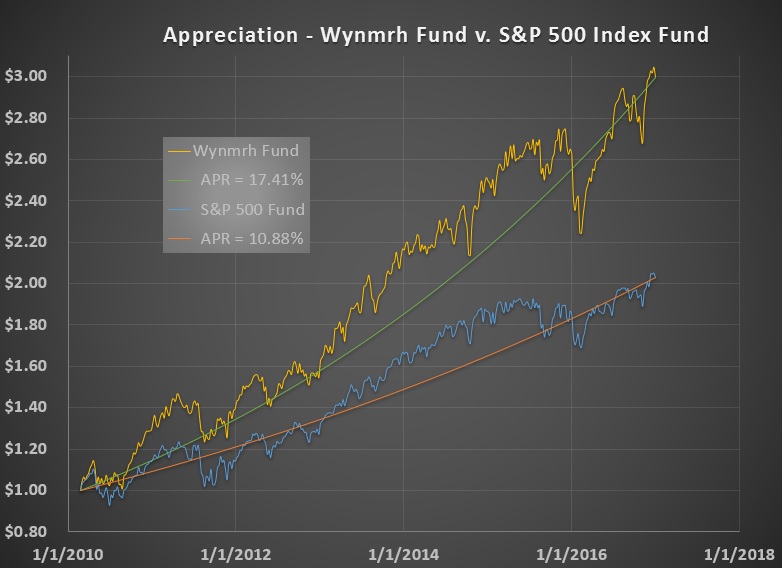

The Wynmrh Fund is ideal for wealth management professionals handling mutual funds. A hybrid universe of Large to Small Cap candidates is selected to achieve acceptable results while reducing volatility. WIA drives all investment decisions. The following benchmark comparison charts are updated bi-annually.

The Wynmrh Fund has tripled between February 26, 2010 and December 31, 2016. By comparison, the S&P 500 benchmark has doubled in the same time period.

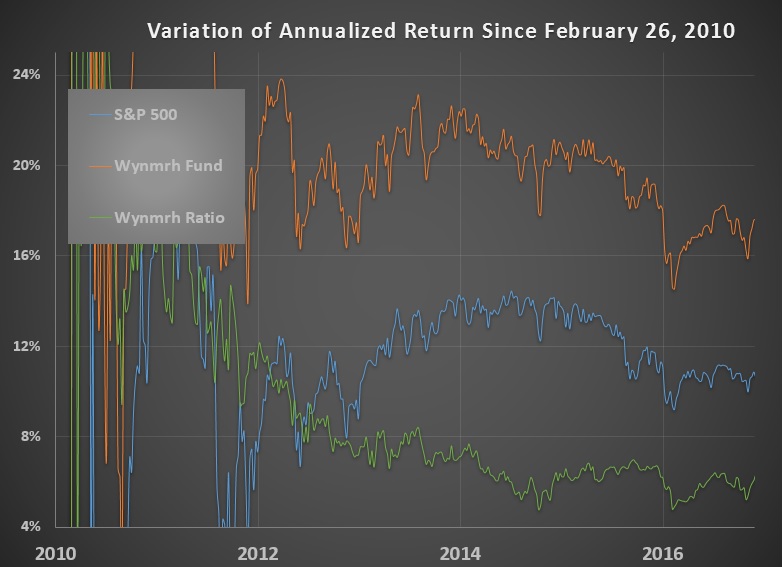

A Ratio to appreciate

From February 26, 2010 to December 31, 2016 the Wynmrh Fund continues to beat our chosen benchmark, the S&P 500.

Our company has generated a diverse product pipeline. The Wynmrh Fund is the culmination of over two decades of applying WIA to target rich groups of marketable securities.